Genus Power Share Price Target 2025 – Share Market Update

Genus Power Infrastructures Limited is an Indian company that specializes in smart metering solutions and power infrastructure projects. Founded in 1992, it is part of the Kailash Group and is headquartered in Jaipur, Rajasthan. Genus Power Share Price on NSE as of 14 April 2025 is 277.60 INR.

Current Market Overview Of Genus Power Share

- Open: 276.00

- High: 280.75

- Low: 272.55

- Mkt cap: 8.44KCr

- P/E ratio: 36.22

- Div yield: 0.22%

- 52-wk high: 486.05

- 52-wk low: 236.85

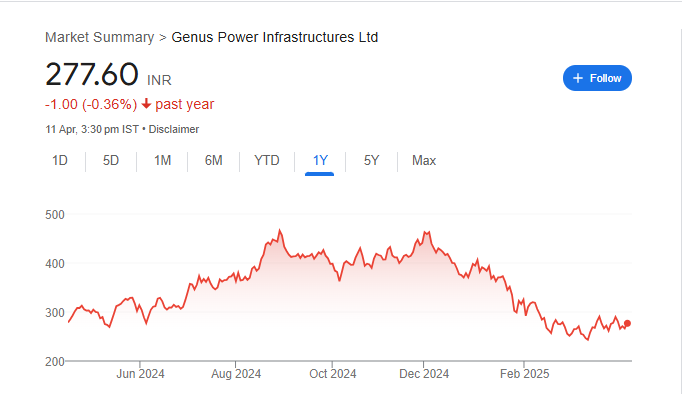

Genus Power Share Price Chart

Shareholding Pattern For Genus Power

- Promoter: 39.39%

- FII: 22.79%

- DII: 3.57%

- Public: 34.26%

Genus Power Share Price Target Tomorrow

| Genus Power Share Price Target Years | Genus Power Share Price Target Months | Genus Power Share Price |

| Genus Power Share Price Target 2025 | April | ₹320 |

| Genus Power Share Price Target 2025 | May | ₹340 |

| Genus Power Share Price Target 2025 | June | ₹360 |

| Genus Power Share Price Target 2025 | July | ₹380 |

| Genus Power Share Price Target 2025 | August | ₹400 |

| Genus Power Share Price Target 2025 | September | ₹420 |

| Genus Power Share Price Target 2025 | October | ₹440 |

| Genus Power Share Price Target 2025 | November | ₹460 |

| Genus Power Share Price Target 2025 | December | ₹490 |

Key Factors Affecting Genus Power Share Price Growth

Here are 6 key factors affecting Genus Power’s share price growth:

1. Growing Demand for Smart Meters

Genus Power is a leading player in smart energy metering. As India focuses on digital power management and smart electricity usage, demand for smart meters is rising. This demand can help Genus get more orders and boost its revenue, supporting share price growth.

2. Government Projects and Reforms

The Indian government is investing in power infrastructure and pushing smart meter rollout through programs like RDSS (Revamped Distribution Sector Scheme). If Genus wins large government contracts, it can lead to better financial performance and positive stock movement.

3. Strong Order Book and Execution

A healthy and growing order book shows business confidence and upcoming revenues. If Genus keeps executing its projects on time and maintains margins, it can lead to steady profits, which is often seen as a positive sign for long-term investors.

4. Partnerships and Joint Ventures

Strategic partnerships with global technology providers or tie-ups with government bodies can improve the company’s capabilities and market reach. These moves often attract investor interest and help improve share price outlook.

5. Shift Towards Renewable Energy and Smart Grid

India’s transition to clean energy and smarter power distribution systems supports companies like Genus. As utilities modernize their networks, smart meter demand is likely to grow, giving the company more opportunities to scale.

6. Positive Financial Performance

If Genus consistently posts good quarterly results with rising profit, low debt, and improved margins, investors may see it as a strong growth stock. Stable financial health plays a key role in driving long-term share price growth.

Risks and Challenges for Genus Power Share Price

Here are 6 key risks and challenges that could affect Genus Power’s share price:

1. Regulatory and Legal Scrutiny

In December 2024, Genus Power’s corporate office and the residence of its Chairman were searched by the Directorate of Enforcement (ED). Although the company stated that its operations remained unaffected and it cooperated fully with authorities, such investigations can impact investor confidence and lead to short-term stock price volatility.

2. High Competition in the Industry

The power infrastructure sector is highly competitive, with major players like Siemens and Schneider Electric. Genus Power needs to continuously innovate and maintain high-quality standards to stay ahead. Failure to do so could result in loss of market share and affect its financial performance.

3. Promoter Share Pledging

A significant portion of Genus Power’s promoter holdings is pledged. High levels of pledged shares can be risky, as any decline in share price might trigger the sale of these shares by lenders, leading to further price drops and reduced investor confidence.

4. Cash Flow Concerns

Despite reporting profits, Genus Power has faced issues with cash flow. In the past year, the company had negative free cash flow, meaning it spent more cash than it generated. This situation can raise concerns about the sustainability of its operations and its ability to fund future projects.

5. Supply Chain Disruptions

Genus Power relies on various components for its products, and disruptions in the supply chain, such as shortages of semiconductors, can delay production and delivery. Such delays can impact revenue and strain relationships with clients.

6. Currency Fluctuations

As Genus Power is involved in international trade, fluctuations in currency exchange rates can affect its procurement costs and profitability. A weaker Indian Rupee against the US Dollar, for instance, can increase the cost of imported materials, impacting margins.

Read Also:- Syncom Formulations Share Price Target 2025 – Share Market Update