Urban Enviro Share Price Target 2025 – Share Market Update

Urban Enviro Waste Management Ltd. is a company specializing in municipal solid waste management services in India. As of April 8, 2025, its share price stands at ₹170.00. Over the past year, the stock has experienced fluctuations, reaching a 52-week high of ₹347.57 and a low of ₹136.05. Urban Enviro Share Price on NSE as of 8 April 2025 is 587.05 INR.

Current Market Overview Of Urban Enviro Share

- Open: 166.00

- High: 173.00

- Low: 165.30

- Mkt cap: 73Cr

- P/E ratio: N/A

- Div yield: 0.29

- 52-wk high: 347.58

- 52-wk low: 136.05

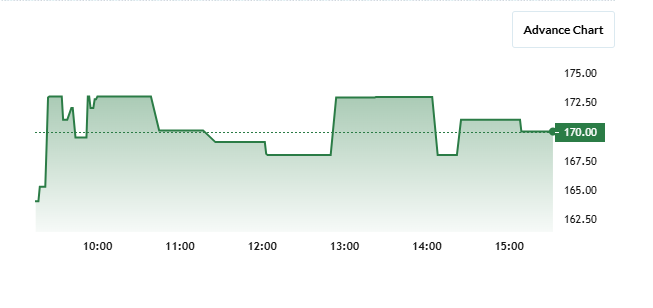

Urban Enviro Share Price Chart

Shareholding Pattern For Urban Enviro

- Promoter: 51.19%

- FII: 0.06%

- DII: 0%

- Public: 48.76%

Urban Enviro Share Price Target Tomorrow

| Urban Enviro Share Price Target Years | Urban Enviro Share Price Target Months | Urban Enviro Share Price |

| Urban Enviro Share Price Target 2025 | April | ₹190 |

| Urban Enviro Share Price Target 2025 | May | ₹210 |

| Urban Enviro Share Price Target 2025 | June | ₹230 |

| Urban Enviro Share Price Target 2025 | July | ₹250 |

| Urban Enviro Share Price Target 2025 | August | ₹270 |

| Urban Enviro Share Price Target 2025 | September | ₹290 |

| Urban Enviro Share Price Target 2025 | October | ₹310 |

| Urban Enviro Share Price Target 2025 | November | ₹330 |

| Urban Enviro Share Price Target 2025 | December | ₹350 |

Key Factors Affecting Urban Enviro Share Price Growth

Urban Enviro Waste Management Ltd. is a company specializing in municipal solid waste management services in India. Several key factors can influence the growth of its share price:

-

Financial Performance

The company’s financial health is a significant determinant of its share price. Urban Enviro has demonstrated strong financial metrics, with a return on equity (ROE) of 51.6% and a return on capital employed (ROCE) of 29.8%. Consistent profitability and efficient capital utilization can enhance investor confidence and positively impact the share price. -

Revenue Growth

Urban Enviro reported an annual revenue growth of 161%, reflecting its expanding operations and market presence. Sustained revenue growth can lead to increased earnings, making the stock more attractive to investors. -

Market Position and Competitive Advantage

As a provider of municipal solid waste management services, Urban Enviro’s ability to secure contracts and maintain strong relationships with local municipalities is crucial. A robust market position and competitive edge can drive business growth and positively influence the share price. -

Operational Efficiency

Effective management of operational costs and resources contributes to profitability. Urban Enviro’s pre-tax margin of 10% indicates healthy operational efficiency, which can enhance investor perception and support share price appreciation. -

Debt Levels and Financial Leverage

The company’s debt-to-equity ratio stands at 0.93, indicating a relatively high level of debt. While leveraging can fuel growth, excessive debt may raise concerns about financial stability. Managing debt effectively is essential to maintain investor confidence and support share price growth. -

Market Sentiment and External Factors

Investor perception, influenced by broader market trends, economic conditions, and industry developments, can impact the share price. Positive news, such as new contract acquisitions or favorable regulatory changes, can boost sentiment, while negative news may have the opposite effect.

Risks and Challenges for Urban Enviro Share Price

Urban Enviro Waste Management Ltd., a company specializing in municipal solid waste management services in India, faces several risks and challenges that could impact its share price:Value Research Online

-

High Debt Levels

The company has a debt-to-equity ratio of 1.39, indicating a significant reliance on borrowed funds. While leveraging can support growth, excessive debt may lead to increased financial obligations and interest expenses, potentially affecting profitability and investor confidence. -

Share Price Volatility

Urban Enviro’s stock has experienced notable fluctuations, with a 52-week high of ₹347.57 and a low of ₹136.05. Such volatility can create uncertainty among investors and may lead to cautious investment behavior. -

Market Competition

The waste management industry is competitive, with several players vying for contracts and market share. Intense competition can pressure profit margins and make it challenging for Urban Enviro to secure new business opportunities. -

Operational Risks

Managing waste involves adherence to strict environmental regulations and operational protocols. Any lapses can lead to legal liabilities, fines, or reputational damage, which could negatively impact the company’s financial performance and share price. -

Liquidity Concerns

The company’s current ratio stands at 2.01, suggesting it has twice the assets needed to cover short-term liabilities. However, maintaining adequate liquidity is essential to meet operational needs and unexpected expenses. Any deterioration in liquidity could raise concerns among investors. -

Regulatory Changes

The waste management sector is subject to evolving environmental laws and regulations. Changes in policies or increased compliance requirements could lead to higher operational costs or necessitate additional investments, potentially impacting profitability and the share price.

Read Also:- Adani Total Gas Share Price Target 2025 – Share Market Update