Pratap Snacks Share Price Target 2025 – Share Market Update

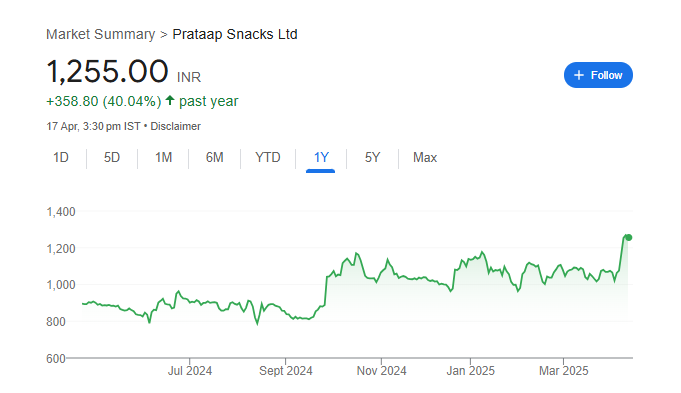

Prataap Snacks Limited, headquartered in Indore, Madhya Pradesh, is a prominent player in India’s snack food industry. Established in 2003, the company has gained recognition through its flagship brand, Yellow Diamond, offering a diverse range of products such as potato chips, extruded snacks, namkeen, and sweet treats. With an extensive distribution network reaching over 2.2 million retail outlets, Prataap Snacks sells approximately 12 million snack packets daily, catering to both urban and rural consumers across the country. Pratap Snacks Share Price on NSE as of 19 April 2025 is 1,255.00 INR.

Current Market Overview Of Pratap Snacks Share

- Open: 1,279.80

- High: 1,279.80

- Low: 1,225.30

- Mkt cap: 3.00KCr

- P/E ratio: N/A

- Div yield: 0.16%

- 52-wk high: 1,295.70

- 52-wk low: 746.70

Pratap Snacks Share Price Chart

Shareholding Pattern For Pratap Snacks

- Promoter: 54.92%

- FII: 6.84%

- DII: 8.51%

- Public: 29.73%

Pratap Snacks Share Price Target Tomorrow

| Pratap Snacks Share Price Target Years | Pratap Snacks Share Price Target Months | Pratap Snacks Share Price |

| Pratap Snacks Share Price Target 2025 | April | ₹1280 |

| Pratap Snacks Share Price Target 2025 | May | ₹1282 |

| Pratap Snacks Share Price Target 2025 | June | ₹1285 |

| Pratap Snacks Share Price Target 2025 | July | ₹1287 |

| Pratap Snacks Share Price Target 2025 | August | ₹1290 |

| Pratap Snacks Share Price Target 2025 | September | ₹1293 |

| Pratap Snacks Share Price Target 2025 | October | ₹1295 |

| Pratap Snacks Share Price Target 2025 | November | ₹1298 |

| Pratap Snacks Share Price Target 2025 | December | ₹1300 |

Key Factors Affecting Pratap Snacks Share Price Growth

Here are six key factors influencing the growth of Prataap Snacks’ share price”:

1. Major Stake Acquisition by New Investors

In late 2024, Authum Investment & Infrastructure and investor Mahi Madhusudan Kela acquired a 46.85% stake in Prataap Snacks. This strategic move, approved by India’s competition regulator, was followed by an open offer for an additional 26% stake, signaling strong investor confidence and potential for future growth.

2. Resilience in the Indian Snack Market

Prataap Snacks operates in India’s thriving snack industry, known for its affordability and mass appeal. The company’s flagship brand, Yellow Diamond, offers a variety of products like chips and namkeen, catering to consistent consumer demand, which supports steady revenue streams.

3. Improved Financial Performance

The company has shown notable improvements in its financial metrics. For instance, the Return on Equity (ROE) increased to 7.28% in FY2024, up from 3.13% in the previous year, indicating better profitability and efficient use of shareholders’ funds.

4. Low Debt Levels

Prataap Snacks maintains a low debt-to-equity ratio of 0.03, reflecting a strong balance sheet with minimal reliance on borrowed funds. This financial stability allows the company to invest in growth opportunities without significant financial risk.

5. Analyst Expectations for Future Growth

Analysts forecast substantial growth for Prataap Snacks, with earnings expected to increase by 114.4% and revenue by 12.4% annually. Such optimistic projections suggest strong future performance and potential appreciation in share value.

6. Strategic Focus on Premium and Healthier Products

The company is expanding into premium and “Better For You” snack segments, aiming to meet evolving consumer preferences. This strategic shift is expected to open new markets and drive revenue growth.

Risks and Challenges for Pratap Snacks Share Price

Here are six key risks and challenges that could impact Prataap Snacks’ share price:

1. Declining Profitability

In the December quarter of FY25, Prataap Snacks reported a net loss of ₹38 crore, despite a 9% increase in revenue. This decline in profitability raises concerns about the company’s financial health and its ability to manage costs effectively.

2. Rising Operational Costs

The company has faced significant increases in operational expenses, with raw material costs and employee benefits contributing to a 19.9% surge. These rising costs can erode profit margins and affect overall financial performance.

3. High Valuation Metrics

Prataap Snacks has a high price-to-book (P/B) ratio of 4.12, which may indicate that the stock is overvalued compared to its actual financial performance. Such valuations can lead to market corrections if the company doesn’t meet growth expectations.

4. Intense Market Competition

The Indian snack food industry is highly competitive, with numerous established players. This intense competition can limit market share growth and put pressure on pricing strategies, affecting revenue and profitability.

5. Dependence on Rural Markets

While the company has seen improved demand in rural areas, urban markets remain subdued. Over-reliance on rural markets can be risky, especially if there are changes in rural consumption patterns or economic conditions.

6. Potential for Institutional Sell-Offs

A significant portion of Prataap Snacks’ shares is held by institutional investors. If these investors decide to sell large blocks of shares, it could lead to a sharp decline in share price due to increased supply in the market.

Read Also:- Tech Mahindra Share Price Target 2025 – Share Market Update