Arihant Capital Share Price Target 2025 – Share Market Update

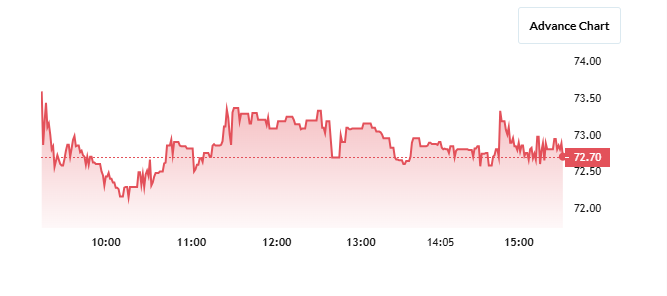

Arihant Capital Markets Limited is a prominent Indian financial services company established in 1992 by Mr. Ashok Jain, a Chartered Accountant. Headquartered in Mumbai, the company offers a comprehensive range of services, including stock and commodity broking, currency derivatives, mutual funds, insurance, wealth management, and merchant banking. As a SEBI-registered intermediary and member of major exchanges like NSE, BSE, MCX, and NCDEX, Arihant Capital serves a diverse clientele, from individual investors to large institutions. Arihant Capital Share Price on NSE as of 21 April 2025 is 72.70 INR.

Current Market Overview Of Arihant Capital Share

- Open: 73.74

- High: 74.01

- Low: 72.01

- Mkt cap: 756Cr

- P/E ratio: N/A

- Div yield: 0.69

- 52-wk high: 124.80

- 52-wk low: 53.20

Arihant Capital Share Price Chart

Shareholding Pattern For Arihant Capital

- Promoter: 69.81%

- FII: 0.51%

- DII: 0%

- Public: 29.68%

Arihant Capital Share Price Target Tomorrow

| Arihant Capital Share Price Target Years | Arihant Capital Share Price Target Months | Arihant Capital Share Price |

| Arihant Capital Share Price Target 2025 | April | ₹70 |

| Arihant Capital Share Price Target 2025 | May | ₹75 |

| Arihant Capital Share Price Target 2025 | June | ₹80 |

| Arihant Capital Share Price Target 2025 | July | ₹85 |

| Arihant Capital Share Price Target 2025 | August | ₹90 |

| Arihant Capital Share Price Target 2025 | September | ₹100 |

| Arihant Capital Share Price Target 2025 | October | ₹110 |

| Arihant Capital Share Price Target 2025 | November | ₹120 |

| Arihant Capital Share Price Target 2025 | December | ₹130 |

Key Factors Affecting Arihant Capital Share Price Growth

Here are six key factors that can influence the growth of Arihant Capital Markets Ltd.’s share price:

1. Strong Financial Growth

Arihant Capital has demonstrated impressive financial performance, with a 33.4% compound annual growth rate (CAGR) in profits over the last five years. Additionally, the company’s revenue increased by 73.25% in 2023 compared to the previous year, and earnings rose by 142.16% during the same period.

2. Efficient Operations

The company has improved its operational efficiency, notably reducing debtor days from 343 to 150. This enhancement in managing receivables contributes to better cash flow and overall financial health.

3. Attractive Valuation

With a price-to-earnings (P/E) ratio of approximately 10.5x, Arihant Capital’s stock is considered attractively valued compared to many peers in the financial services sector. This lower valuation may appeal to value-focused investors.

4. Diverse Service Offerings

Arihant Capital provides a wide range of financial services, including stock and commodity broking, portfolio management, mutual funds, and insurance. This diversification helps the company cater to various client needs and reduces dependence on a single revenue stream.

5. Low Debt Levels

The company maintains a healthy financial structure with a low net debt-to-equity ratio of 0.37. This conservative approach to leveraging supports financial stability and reduces risk.

6. Promoter Confidence

Promoters hold a significant stake of approximately 69.81% in the company, indicating strong confidence in its future prospects. Such substantial promoter holding often aligns management’s interests with those of shareholders.

Risks and Challenges for Arihant Capital Share Price

Here are six key risks and challenges that could impact the share price of Arihant Capital Markets Ltd:

1. Significant Revenue Decline

The company experienced a 32.02% quarter-on-quarter revenue decline, marking its lowest performance in the past three years. Such a substantial drop can raise concerns about the company’s operational efficiency and future earnings potential.

2. High Stock Volatility

Arihant Capital’s stock is notably volatile, being approximately 3.96 times more volatile than the Nifty index. This high volatility can lead to unpredictable share price movements, which may deter risk-averse investors.

3. Decreasing Promoter Holding

Over the last three years, the promoters’ stake in the company has decreased by 4.76%. A declining promoter holding might be perceived as reduced confidence in the company’s long-term prospects.

4. Substantial Contingent Liabilities

The company has reported contingent liabilities amounting to ₹295 crore. These potential obligations could pose financial risks if they materialize, affecting the company’s profitability and share value.

5. Operational Challenges in Trading Infrastructure

Previously, the company faced latency issues in its trading database engine, which hindered trade executions. Although improvements have been made, any future technical glitches could impact customer satisfaction and revenue.

6. Exposure to Market Fluctuations

As a financial services firm, Arihant Capital’s performance is closely tied to market conditions. Economic downturns or unfavorable market trends can adversely affect its revenue streams and, consequently, its share price.

Read Also:- Gennex Laboratories Share Price Target 2025 – Share Market Update