INDIGO Share Price Target 2025 – Share Market Update

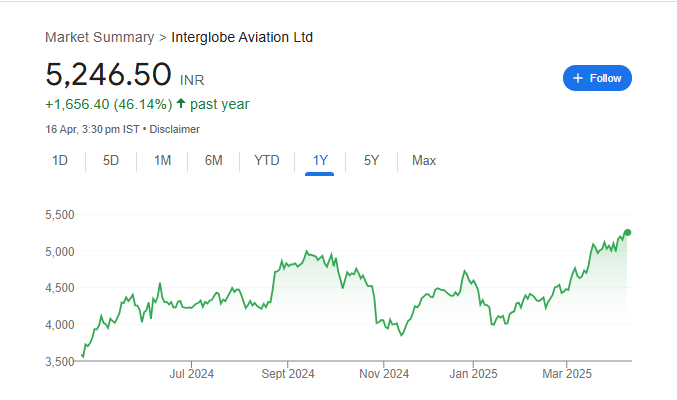

IndiGo, operated by InterGlobe Aviation Limited, is India’s largest airline, renowned for its extensive domestic network and growing international presence. IndiGo has achieved significant growth, with a 46.10% increase in its share price over the last year, and has set a new 52-week high of ₹5,347.00. The airline’s market capitalization stands at approximately ₹2.03 trillion, underscoring its substantial position in the aviation sector. INDIGO Share Price on NSE as of 17 April 2025 is 5,246.50 INR.

Current Market Overview Of INDIGO Share

- Open: 5,260.00

- High: 5,285.00

- Low: 5,200.50

- Mkt cap: 2.03LCr

- P/E ratio: 33.34

- Div yield: N/A

- 52-wk high: 5,347.00

- 52-wk low: 3,441.05

INDIGO Share Price Chart

Shareholding Pattern For INDIGO

- Promoter: 53.92%

- FII: 12.5%

- DII: 17.06%

- Public: 16.52%

INDIGO Share Price Target Tomorrow

| INDIGO Share Price Target Years | INDIGO Share Price Target Months | INDIGO Share Price |

| INDIGO Share Price Target 2025 | April | ₹5290 |

| INDIGO Share Price Target 2025 | May | ₹5300 |

| INDIGO Share Price Target 2025 | June | ₹5310 |

| INDIGO Share Price Target 2025 | July | ₹5320 |

| INDIGO Share Price Target 2025 | August | ₹5330 |

| INDIGO Share Price Target 2025 | September | ₹5340 |

| INDIGO Share Price Target 2025 | October | ₹5350 |

| INDIGO Share Price Target 2025 | November | ₹5360 |

| INDIGO Share Price Target 2025 | December | ₹5370 |

Key Factors Affecting INDIGO Share Price Growth

Here are six key factors influencing the growth of IndiGo’s share price:

1. Dominant Market Position

IndiGo holds a significant share of India’s domestic aviation market, operating over 2,200 daily flights and serving more than 31 million passengers in a single quarter. This strong market presence contributes to consistent revenue streams and investor confidence.

2. Strategic International Expansion

The airline is actively expanding its international footprint, aiming to increase international capacity from 25% to 40% by fiscal year 2030. This includes introducing new destinations and acquiring wide-body aircraft like the Airbus A350s, positioning IndiGo to tap into growing global travel demand.

3. Fleet Expansion Plans

IndiGo plans to expand its fleet to over 600 aircraft by FY30, enhancing its ability to serve more routes and passengers. This expansion supports the airline’s growth strategy and can lead to increased market share and revenues.

4. Favorable Fuel Price Trends

Recent declines in crude oil prices have reduced operational costs for airlines. Lower fuel expenses can improve profit margins, making the airline more attractive to investors and positively influencing its share price.

5. Strong Financial Performance

IndiGo has demonstrated robust financial results, with a 14% year-over-year revenue growth and expectations of a net profit of ₹2,300 crore in Q4 FY25. Such financial strength enhances investor trust and can drive share price growth.

6. Positive Analyst Outlook

Financial analysts have shown optimism about IndiGo’s prospects, with firms like Motilal Oswal upgrading the stock to a ‘buy’ rating and setting higher target prices. Such endorsements can boost investor sentiment and contribute to share price appreciation.

Risks and Challenges for INDIGO Share Price

Here are six key risks and challenges that could influence the share price of IndiGo (InterGlobe Aviation Ltd.):

1. Grounded Aircraft Due to Engine Issues

IndiGo has faced challenges with a significant number of its aircraft being grounded due to issues with Pratt & Whitney engines. At one point, over 70 planes were out of service, leading to increased maintenance costs and reduced capacity. Such operational disruptions can impact the airline’s revenue and, consequently, its share price.

2. Volatility in Fuel Prices and Currency Exchange Rates

The airline industry is sensitive to fluctuations in fuel prices and currency exchange rates. For IndiGo, rising fuel costs and a depreciating Indian rupee have led to higher operational expenses. These factors can squeeze profit margins and affect investor sentiment.

3. Intense Market Competition

IndiGo operates in a highly competitive environment, facing challenges from both domestic and international carriers. The resurgence of competitors like Air India and the entry of new players can lead to pricing pressures and potential loss of market share, which may influence the company’s stock performance.

4. Delays in Aircraft Deliveries

The company’s growth plans rely on the timely delivery of new aircraft. However, any delays in receiving these planes can hinder expansion efforts, limit capacity growth, and potentially affect revenue projections, thereby impacting the share price.

5. High Valuation Concerns

Some analysts have expressed concerns about IndiGo’s stock being priced higher than its peers, suggesting that the current valuation may already reflect optimistic future growth. If the company fails to meet these high expectations, it could lead to a reevaluation of the stock’s worth.

6. Reputation and Customer Satisfaction Issues

IndiGo’s ranking in global airline assessments has raised questions about its service quality. Negative perceptions can influence customer choices and brand loyalty, which, in turn, may affect the company’s financial performance and stock value.

Read Also:- Hindalco Share Price Target 2025 – Share Market Update