Denta Water and Infra Solutions Share Price Target 2025 – Share Market Update

Denta Water and Infra Solutions is a company focused on water management and infrastructure projects, primarily in India. It specializes in water revitalization and groundwater recharge initiatives. The company was listed on the BSE and NSE following a successful IPO, which was oversubscribed by more than 220 times, signaling strong investor interest. Denta Water operates with an asset-light model, relying on subcontractors for manpower and equipment, which helps keep costs lower and increases profitability. It has a strong order book with a significant number of ongoing projects. Denta Water and Infra Solutions Share Price on NSE as of 18 April 2025 is 302.00 INR.

Current Market Overview Of Denta Water and Infra Solutions Share

- Open: 306.00

- High: 307.45

- Low: 300.05

- Mkt cap: 806.34Cr

- P/E ratio: 13.60

- Div yield: N/A

- 52-wk high: 377.70

- 52-wk low: 251.25

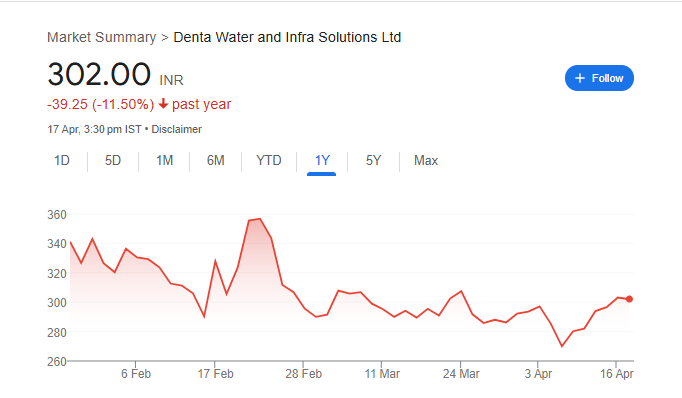

Denta Water and Infra Solutions Share Price Chart

Shareholding Pattern For Denta Water and Infra Solutions

- Promoter: 71%

- FII: 3.68%

- DII: 9.11%

- Public: 15.30%

Denta Water and Infra Solutions Share Price Target Tomorrow

| Denta Water and Infra Solutions Share Price Target Years | Denta Water and Infra Solutions Share Price Target Months | Denta Water and Infra Solutions Share Price |

| Denta Water and Infra Solutions Share Price Target 2025 | April | ₹310 |

| Denta Water and Infra Solutions Share Price Target 2025 | May | ₹320 |

| Denta Water and Infra Solutions Share Price Target 2025 | June | ₹330 |

| Denta Water and Infra Solutions Share Price Target 2025 | July | ₹340 |

| Denta Water and Infra Solutions Share Price Target 2025 | August | ₹350 |

| Denta Water and Infra Solutions Share Price Target 2025 | September | ₹360 |

| Denta Water and Infra Solutions Share Price Target 2025 | October | ₹370 |

| Denta Water and Infra Solutions Share Price Target 2025 | November | ₹380 |

| Denta Water and Infra Solutions Share Price Target 2025 | December | ₹390 |

Key Factors Affecting Denta Water and Infra Solutions Share Price Growth

Here are Several factors can influence the growth of its share price:

1. Strong Order Book

As of November 30, 2024, Denta Water had 17 ongoing projects with a total contract value of ₹1,100.44 crore, of which ₹1,066.75 crore pertains to water management projects. This robust order book provides revenue visibility and reflects the company’s strong project pipeline.

2. Specialization in Water Management

The company’s expertise in water revitalization and groundwater recharge positions it favorably in a niche yet essential segment of infrastructure development. This specialization can lead to a competitive advantage and potential for growth in related projects.

3. Asset-Light Business Model

Denta Water employs an asset-light approach by outsourcing critical construction equipment and utilizing subcontractors for manpower and equipment support. This strategy reduces capital expenditure and maintenance costs, potentially enhancing profitability.

4. Successful IPO and Market Debut

The company’s IPO was oversubscribed 221.68 times, indicating strong investor interest. Shares listed at ₹330 on the BSE, reflecting a 12.24% premium over the issue price of ₹294, demonstrating positive market reception.

5. Financial Performance

In the fiscal year ending March 2024, Denta Water reported a net profit of ₹60 crore, marking a 21.3% year-over-year growth. Consistent financial performance can boost investor confidence and support share price growth.

6. Government Infrastructure Initiatives

The company’s focus on water management aligns with government initiatives aimed at improving water infrastructure. Participation in such programs can lead to increased project opportunities and revenue streams.

Risks and Challenges for Denta Water and Infra Solutions Share Price

Here are six key risks and challenges that could impact the share price of Denta Water and Infra Solutions:

1. Dependence on Government Contracts

The company relies heavily on government contracts, especially in Karnataka. Any delays, cancellations, or changes in government policies can significantly affect project timelines and revenue, posing risks to its financial stability.

2. Geographical Concentration

Currently, Denta Water’s operations are primarily concentrated in Karnataka. Expanding into new regions like Northern and Southern India presents challenges, including adapting to local regulations and managing logistical complexities, which could impact growth prospects.

3. Legal and Regulatory Scrutiny

The company and its promoters have faced past legal proceedings and investigations. Ongoing regulatory scrutiny and complaints from SEBI could affect investor confidence and the company’s reputation, potentially influencing share price negatively.

4. Low Entry Barriers in the Industry

The water infrastructure sector has relatively low entry barriers, leading to intense competition from both small and established players. This competition can pressure profit margins and make it challenging to maintain a competitive edge.

5. Financial Performance Concerns

Despite revenue growth, the company’s profitability margins have been declining. For instance, the EBITDA margin decreased from 43.33% in FY22 to 33.51% in FY25, indicating potential challenges in cost management and operational efficiency.

6. Customer Concentration Risk

Denta Water’s reliance on a limited number of clients for a significant portion of its revenue exposes it to risks. The loss of a major client or delays in payments can adversely affect cash flow and financial stability.

Read Also:- Punjab and Sind Bank Share Price Target 2025 – Share Market Update