Ajax Engineering Share Price Target 2025 – Share Market Update

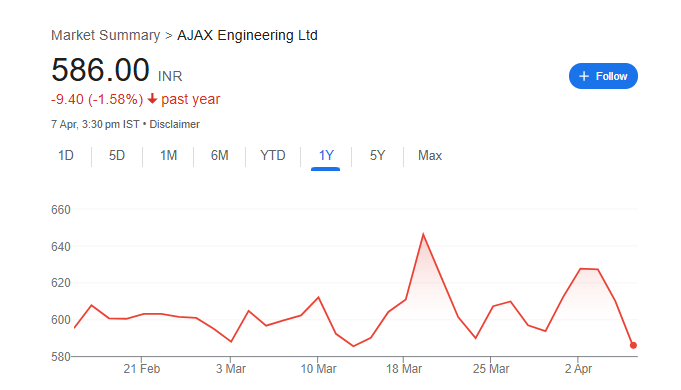

Ajax Engineering Limited, a key player in India’s concrete equipment manufacturing sector, has recently entered the public market. The company’s shares debuted on February 17, 2025, listing at ₹575 on the NSE, which was an 8.43% discount to the IPO price of ₹629. Following the listing, the stock experienced further declines but showed signs of recovery, trading at ₹593.20 as of 2:20 pm IST on the same day. As of April 4, 2025, the share price was ₹608.00. Ajax Engineering Share Price on NSE as of 7 April 2025 is 586.00 INR.

Current Market Overview Of Ajax Engineering Share

- Open: 549.10

- High: 588.35

- Low: 549.10

- Mkt cap: 6.64KCr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 658.30

- 52-wk low: 549.10

Ajax Engineering Share Price Chart

Shareholding Pattern For Ajax Engineering

- Promoter: 80%

- FII: 5.02%

- DII: 5.47%

- Public: 9.51%

Ajax Engineering Share Price Target Tomorrow

| Ajax Engineering Share Price Target Years | Ajax Engineering Share Price Target Months | Ajax Engineering Share Price |

| Ajax Engineering Share Price Target 2025 | April | ₹600 |

| Ajax Engineering Share Price Target 2025 | May | ₹605 |

| Ajax Engineering Share Price Target 2025 | June | ₹610 |

| Ajax Engineering Share Price Target 2025 | July | ₹615 |

| Ajax Engineering Share Price Target 2025 | August | ₹620 |

| Ajax Engineering Share Price Target 2025 | September | ₹630 |

| Ajax Engineering Share Price Target 2025 | October | ₹640 |

| Ajax Engineering Share Price Target 2025 | November | ₹650 |

| Ajax Engineering Share Price Target 2025 | December | ₹660 |

Key Factors Affecting Ajax Engineering Share Price Growth

Ajax Engineering Limited, a prominent Indian manufacturer of concrete equipment, has several key factors that can influence the growth of its share price:

-

Market Leadership in Self-Loading Concrete Mixers (SLCMs)

Ajax holds a dominant position in the Indian SLCM market, with a 77% market share as of September 2024. This leadership reflects strong brand recognition and customer trust, which can positively impact investor confidence and share price growth. -

Diversified Product Portfolio

The company offers a comprehensive range of concrete equipment, including batching plants, transit mixers, and concrete pumps. This diversification allows Ajax to cater to various segments within the construction industry, potentially leading to increased revenue streams and supporting share price appreciation. -

Strong Financial Performance

Consistent revenue growth and profitability are crucial for share price enhancement. Investors often look for companies with robust financial health, as it indicates operational efficiency and the potential for future expansion. -

Expansion into International Markets

Ajax’s presence in regions such as Asia, the Middle East, Europe, and Africa diversifies its revenue base and reduces dependence on the domestic market. Successful international expansion can open new opportunities and contribute to share price growth. -

Investment in Research and Development (R&D)

Continuous innovation and the development of new technologies can provide Ajax with a competitive edge. Effective R&D efforts can lead to the introduction of advanced products, meeting evolving customer needs and potentially boosting market share and share price. -

Favorable Industry Trends

The increasing focus on infrastructure development and urbanization in India and other regions drives demand for construction equipment. Ajax is well-positioned to benefit from these trends, which can positively influence its financial performance and share price.

Risks and Challenges for Ajax Engineering Share Price

Ajax Engineering Limited, a notable player in the concrete equipment manufacturing sector, faces several risks and challenges that could influence its share price:

-

Dependence on Self-Loading Concrete Mixers (SLCMs): A significant portion of Ajax Engineering’s revenue, approximately 85.13% in FY24, is derived from the sale of SLCMs. This heavy reliance means that any decline in demand for SLCMs could adversely affect the company’s financial performance and, consequently, its share price. ICICI Direct

-

Seasonal Business Fluctuations: The company’s operations are subject to seasonal variations, with certain periods experiencing higher sales volumes. Any downturn during these peak seasons could negatively impact overall financial results and investor confidence.

-

Concentration of Manufacturing Facilities: Ajax Engineering relies heavily on its Obadenahalli facility, where 99.06% of its SLCMs were assembled as of September 30, 2024. Disruptions at this facility, due to factors like natural disasters or labor issues, could significantly hinder production and financial outcomes.

-

Supply Chain Disruptions: Global supply chain issues, such as those exacerbated by events like the COVID-19 pandemic, can lead to shortages of raw materials and components. These disruptions may delay production schedules and increase costs, impacting the company’s ability to meet customer demands and affecting its share price.

-

Intense Market Competition: The concrete equipment industry is highly competitive, with numerous established players and new entrants. This intense competition can pressure pricing strategies and market share, potentially impacting Ajax Engineering’s profitability and share price.

-

Regulatory and Economic Risks: Changes in government policies, regulations, and budgetary allocations can significantly impact the company’s operations and profitability. Additionally, fluctuations in economic conditions, civil unrest, and shifts in local government policies pose potential risks to the company’s financial stability and share price.

Read Also:- Salzer Electronics Share Price Target 2025 – Share Market Update