Sahaj Solar Share Price Target 2025 – Share Market Update

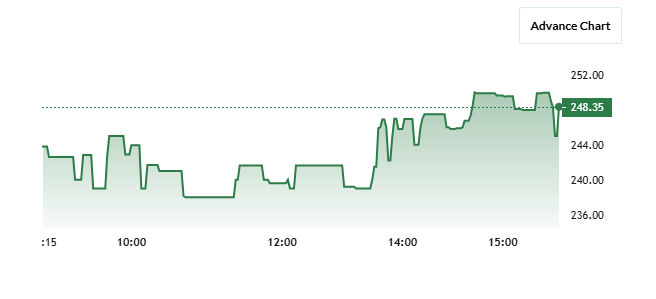

Sahaj Solar is an Indian company focused on providing solar energy solutions, including solar panels, EPC (Engineering, Procurement, and Construction) services, and solar-powered products. It plays a role in supporting the clean energy movement by offering sustainable alternatives to traditional power sources. The company has gained attention in the stock market for its entry into the green energy sector, which is expected to grow in the coming years. Sahaj Solar Share Price on NSE as of 18 April 2025 is 248.35 INR.

Current Market Overview Of Sahaj Solar Share

- Open: 242.60

- High: 250.00

- Low: 238.00

- Mkt cap: 545Cr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 395.00

- 52-wk low: 150.00

Sahaj Solar Share Price Chart

Shareholding Pattern For Sahaj Solar

- Promoter: 71.28%

- FII: 0.03%

- DII: 0%

- Public: 28.69%

Sahaj Solar Share Price Target Tomorrow

| Sahaj Solar Share Price Target Years | Sahaj Solar Share Price Target Months | Sahaj Solar Share Price |

| Sahaj Solar Share Price Target 2025 | April | ₹270 |

| Sahaj Solar Share Price Target 2025 | May | ₹290 |

| Sahaj Solar Share Price Target 2025 | June | ₹310 |

| Sahaj Solar Share Price Target 2025 | July | ₹330 |

| Sahaj Solar Share Price Target 2025 | August | ₹350 |

| Sahaj Solar Share Price Target 2025 | September | ₹360 |

| Sahaj Solar Share Price Target 2025 | October | ₹370 |

| Sahaj Solar Share Price Target 2025 | November | ₹380 |

| Sahaj Solar Share Price Target 2025 | December | ₹400 |

Key Factors Affecting Sahaj Solar Share Price Growth

Here are six key factors influencing the growth of Sahaj Solar’s share price:

1. Strong Revenue and Profit Growth

Sahaj Solar has demonstrated impressive financial performance, with a 71% increase in standalone sales from ₹179 crore in FY24 to ₹307 crore in FY25. Additionally, the company achieved a 109% growth in profit after tax (PAT) in FY24, indicating robust operational efficiency and profitability.

2. High Return on Equity (ROE)

The company boasts a healthy ROE of 42.5% over the past three years, surpassing the industry average. This high ROE reflects effective management and the company’s ability to generate substantial profits from its equity base.

3. Minimal Debt Levels

Sahaj Solar has significantly reduced its debt, making it almost debt-free. This financial stability allows the company to reinvest earnings into growth initiatives without the burden of high interest obligations.

4. Diversified Product Portfolio

Engaged in manufacturing photovoltaic (PV) modules, providing solar water pumping systems, and offering engineering, procurement, and construction (EPC) services, Sahaj Solar’s diversified offerings position it well to capitalize on various segments of the renewable energy market.

5. Positive Share Price Momentum

Over the past year, Sahaj Solar’s share price has increased by approximately 34.22%, reaching a 52-week high of ₹395. This upward trend reflects growing investor confidence in the company’s prospects.

6. Strategic Reinvestment of Profits

The company is effectively reinvesting its profits back into the business, leading to significant earnings growth. This strategy indicates a focus on long-term value creation, which can positively influence the share price.

Risks and Challenges for Sahaj Solar Share Price

Here are six key risks and challenges that could influence Sahaj Solar’s share price:

1. High Accrual Ratio and Negative Free Cash Flow

Sahaj Solar has an accrual ratio of 0.61 for the year ending September 2024, which is considered high and may indicate that earnings are not being converted into cash efficiently. Additionally, the company reported negative free cash flow of ₹244 million, despite a profit of ₹160.3 million, raising concerns about its cash-generating ability.

2. Dependence on Limited Customer Base

The company relies heavily on a few customers for its sales. This concentration risk means that losing a major client could significantly impact revenue and profitability.

3. Exposure to Raw Material Price Fluctuations

Sahaj Solar’s operations are susceptible to changes in the prices of raw materials. Any significant increase in input costs could squeeze profit margins and affect financial performance.

4. Supply Chain Vulnerabilities

The company depends on imported solar components, making it vulnerable to supply chain disruptions, tariffs, or trade restrictions. Such issues can lead to delays, increased costs, and potential project setbacks.

5. Regulatory and Environmental Risks

Changes in government policies, environmental regulations, or climatic conditions affecting solar radiation levels could impact the efficiency and viability of solar projects, thereby influencing the company’s performance.

6. Potential Regulatory Actions

The company has received a notice from the MSME Commissionerate for delayed payments under the MSMED Act, 2006. Such regulatory issues can lead to penalties and affect the company’s reputation.

Read Also:- INDIGO Share Price Target 2025 – Share Market Update